how much did you pay in taxes doordash

Expect to pay at least a 25 tax rate on your DoorDash income. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation.

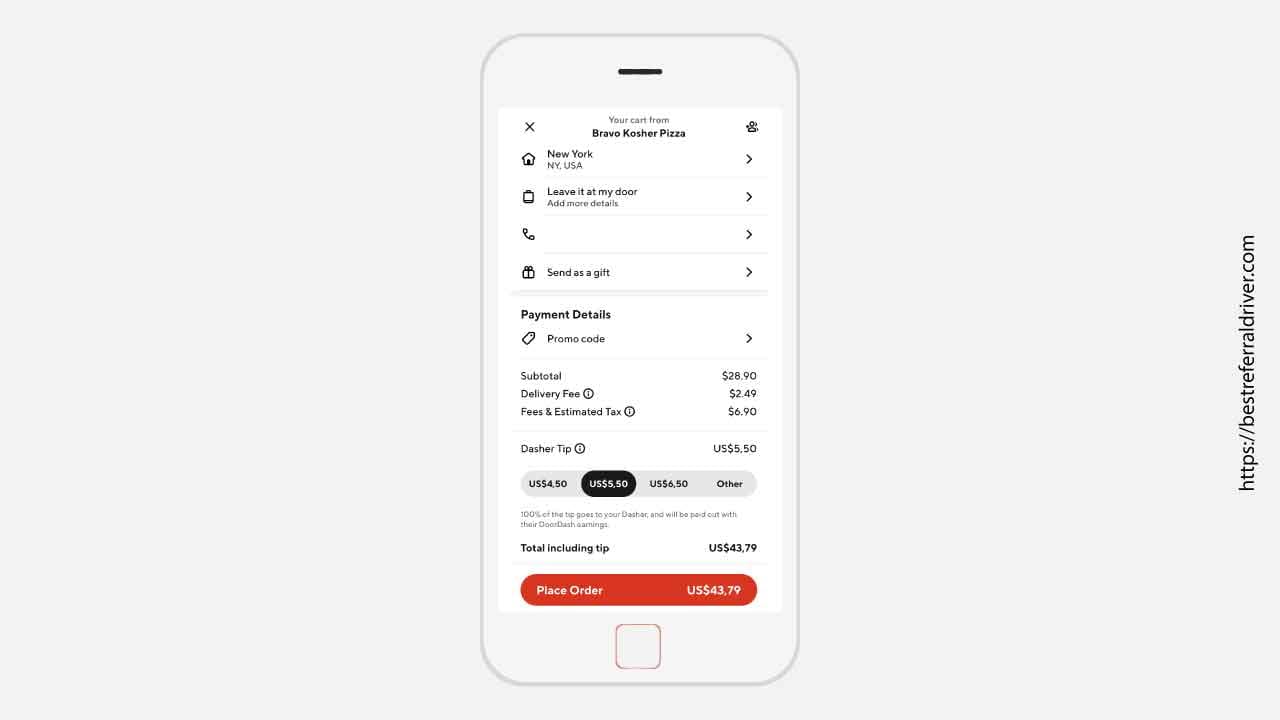

Doordash Fees How Much Does Doordash Cost In 2022

Yes since you received income through the platform you must file taxes to report your income and pay any potential tax liability.

. January 15 2022 January 15 2023 Receive. The type of item purchased The time and date of the purchase The location of the store and your delivery. If how much do you pay in taxes doordash reddit by mail the.

Just make sure theyre not already being reimbursed to you. DoorDash also said in 2019 that the average DoorDash driver can earn around 1850 per hour. If you know what your doing then this job is almost tax free.

I keep my daily mileage in a. The amount of tax charged depends on many factors including the following. The employment site ZipRecruiter found that DoorDash delivery drivers who work in the following cities earn the most on average.

How do you calculate taxes on a 1099. How much do you have to pay in taxes for Doordash. You still have to pay DoorDash taxes if you made under 600 and didnt receive a 1099.

However food delivery in Doordash has a different tax payment policy with employees. We already know that the tax rate for income up to 9700 is 10. How much did you pay in taxes doordash reddit.

How much do you pay in taxes if you do DoorDash. If you wish to simplify your write-off tracking use Keeper Tax to monitor your expenses and find the write-offs. By Mar 1 2021 Uncategorized 0 comments Mar 1 2021 Uncategorized 0 comments.

This is the reported income a Dasher will use to file. Fourth Quarter Estimated Tax Payment Due. It doesnt apply only to.

Yes - Just like everyone else youll need to pay taxes. Working for Door Dash you may claim 55 cents a mile deduction on your Door Dash income for tax purposes. If you drove 500 miles all year thats another 26 off your taxes.

Under the policy those who work as food deliverymen will receive a 1099-K form. Didnt get a 1099. Rather you are paying taxes on the income you earned from 6001-10000 dollars.

Tolls Any toll fees that you pay while working are tax deductible. How Old Do You Have To Be To DoorDash. This will substantially reduce your taxable income.

Paying taxes as a 1099 worker As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. From there youll input your total business profit on the Schedule SE which will determine how much in taxes youll pay on your independent income. Final words If youre new to the gig economy dealing with taxes can be.

Basic Deductions- mileage new phone phone. If you earned 600 or more in 2021 on the DoorDash platform youll receive a 1099-NEC form via our partner Stripe. You get to subtract 575 cents from your income or about 9 cents from your taxes for every mile you drove for DoorDash.

You will owe income taxes on that money at the regular tax rate. 2167 per hour Berkeley. How much do Dashers pay in taxes.

If you earned more than 600 while working for DoorDash you are required to pay taxes. This includes 153 in self-employment taxes for Social Security and. So you would.

Im only paying 900 in taxes on my DoorDash earnings after making 26k last year. Click here to visit the Stripe Support article.

Doordash Delivery Driver What I Wish I Knew Before Taking The Job

How Much Money Have You Made Using Doordash Quora

How Can I View My Delivery History With Doordash

Do I Owe Taxes Working For Doordash Net Pay Advance

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Many People Use Doordash In 2022 New Data

Doordash Filing 1099 Taxes The Process Youtube

How Much Do Doordash Drivers Make We Break Down The Numbers

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

How Much Can You Make On Doordash In A Day

How To Get Your 1099 Tax Form From Doordash

9 Best Tax Deductions For Doordash Drivers In 2022 Everlance

How Do Food Delivery Couriers Pay Taxes Get It Back

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash Driver Pay After Taxes Is It Worth It 2021 2022 Youtube

Doordash Driver Review How Much Money Can You Make

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver